Buying life insurance can seem very daunting, but we are here to help you get started. First, it’s important to understand the differences between term life insurance and whole life insurance. Then, we’ll take a look at return of premium life insurance, as it’s a blend of the two options.

Term Life Insurance vs. Whole Life Insurance

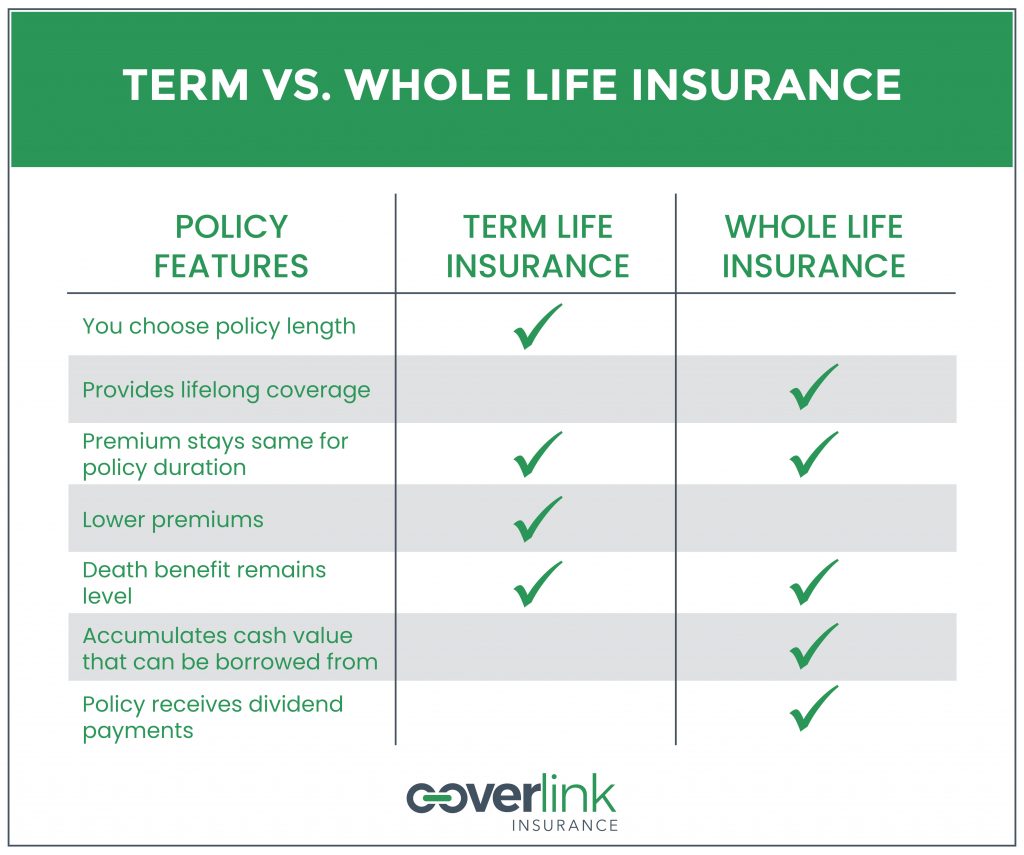

Both types have their benefits and drawbacks. Term life insurance is affordable and straightforward, while whole life insurance doesn’t expire but is more expensive. Term life insurance covers you for a shorter period, but it’s cheaper and simpler, while whole life insurance can give you lifelong coverage and provide extra support during retirement. Regardless, after you’re gone, your family can use the proceeds from either type of policy to cover funeral costs, mortgage payments, college tuition and other expenses.

To decide between term or whole life insurance, it’s important to know how they’re different and what makes them right for your financial scenario.

So, let’s dive in…

Term Life Insurance is the easiest to understand and has the lowest prices. It covers you for a fixed period of time, like 10, 20 or 30 years. It’s often called “pure life insurance” because it’s designed only to protect your dependents in case you die prematurely. If you have a term policy and die within the term, your beneficiaries receive the payout. The policy has no other value.

You choose the term when you buy the policy. Again, the common terms are 10, 20 and 30 years. With most policies, the payout — called the death benefit — and the cost, or premium, stay the same throughout the term.

When you shop for term life:

- Choose a term that covers the years you’ll be paying the bills and want life insurance in case you die.

- Buy an amount your family would need if you were no longer there to provide for them. The payout could replace your income and help your family pay for services you perform now, such as child care.

Ideally, your need for life insurance will end around the time the term life policy expires: Your kids will be on their own, you’ll have paid off your house and you’ll have plenty of money in savings to serve as a financial safety net.

Whole Life Insurance is more complex and tends to cost more than term, but it offers additional benefits. Whole life is the most well-known and simplest form of permanent life insurance, which covers you until you die. It also provides a cash-value account that you can tap for funds later in life.

It provides lifelong coverage and includes an investment component known as the policy’s cash value. The cash value grows slowly in a tax-deferred account, meaning you won’t pay taxes on its gains while they’re accumulating.

You can borrow money against the account or surrender the policy for cash. But if you don’t repay policy loans with interest, you’ll reduce your death benefit, and if you surrender the policy, you’ll no longer have coverage.

Although it’s more complicated than term life insurance, whole life is the most straightforward form of permanent life insurance. Here’s why:

- The premium remains the same for as long as you live.

- The death benefit is guaranteed.

- The cash value account grows at a guaranteed rate.

Some whole life policies can also earn annual dividends, which pay you back with a bit of the insurer’s profit. You can take the dividends in cash, leave them in your account to earn interest or use them to decrease your premium payments, repay policy loans or buy additional coverage. Dividends are not guaranteed.

Term Life vs. Whole Life: Cost Comparison

Term life insurance is cheap because it’s temporary and has no cash value; in most cases, your family won’t receive a payout because you’ll live to the end of the term. Whole life insurance premiums are much higher because the coverage lasts for a lifetime, and the policy has cash value, with a guaranteed rate of investment return on a portion of the money that you pay.

Term Life vs. Whole Life: Which to Choose

Chose term life if you:

- Only need life insurance to replace your income over a certain period, such as the years you’re raising children or paying off your mortgage.

- Want the most affordable coverage.

- Think you might want permanent life insurance but can’t afford it. Most term life policies are convertible to permanent coverage. The deadline for conversion varies by policy.

- Think you can invest your money better. Buying a cheaper term life policy lets you invest what you would have paid for a whole life policy.

Choose whole life if you:

- Want to provide money for your heirs to pay inheritance or estate taxes. In 2020, estates worth more than $11.58 million per individual or $23.16 million per couple are subject to federal estate taxes. State inheritance and estate taxes vary.

- Have a lifelong dependent, such as a child with special needs. Life insurance can fund a special needs trust to provide care for your child after you’re gone. Consult with an attorney and financial advisor if you want to set up a trust.

- Want to spend your retirement savings and still leave an inheritance or money for final expenses, such as funeral costs.

- Want to equalize inheritances. If you plan to leave a business or property to one child, whole life insurance could compensate your other children

Can’t decide between the two? Maybe Return of Premium Life Insurance is right for you.

While there are many excellent Term Life Insurance policies available, Term with Return of Premium ensures you’ll receive 100% of your premiums back at the end of the term period if coverage is never used.

You buy a return of premium term life insurance policy, perhaps for a 20- or 30-year term. If you die during that time, your beneficiaries receive the death benefit. If you outlive the policy, you get back exactly what you paid in (with no interest). The money back is not taxable.

With a regular term life insurance policy, if you are still living when the policy expires, you get nothing back. The premium is set for the entire duration of the policy – it would not increase every year, but if you’re living at the end of the policy period, the policy ends and the premium paid is often viewed as a waste.

Return of premium policies are similar to a regular term life insurance policy, with the major exception that if you’re living at the end of the term period, you have two choices of what you can do with your policy.

- You could elect to take all the premium paid over the life of the policy in a lump sum payment (refund) from the insurance company; or

- You could choose to use that policy value (the accumulation of what you paid for the life of the term) to purchase a fully paid insurance coverage amount (referred to as the Paid-Up Insurance amount).

But everything has a price, right? The return of premium policy is a more expensive option, but some people would prefer to get their premium back if they’re still living at the end of the policy.

We’re here to help.

As with any life insurance policy, it’s important to understand each option and decide which scenario best fits you. And that’s what we are here to help you with. To learn more about life insurance, visit our Resource Center, or contact one of our Licensed Advisors and we will work with you to find the perfect policy for you.