Consider this…the unthinkable happens – a faulty electrical connection causes a fire in your kitchen. While the fire is isolated to the kitchen, there is smoke damage throughout the house that makes it unlivable. There is an often-overlooked coverage in your homeowners insurance Ohio policy that can help you in this situation.

Additional Living Expense (ALE) coverage is an automatic part of your homeowners coverage (usually shown as “Coverage D” in your homeowners policy). The coverage limit is usually between 20 and 30 percent of the limit you carry on your house. So, if your house is insured for $100,000, you would probably have at least a $20,000 limit for additional living expenses. Some insurance companies go so far as to provide coverage for the actual loss you suffer (there is no 20% or 30% limit on your coverage).

The key to understanding this coverage is the term “additional.” ALE coverage pays for expenses that you wouldn’t have if not for your insurance claim. If your meal expenses are higher than your grocery expenses were before the loss, this coverage will pay you the difference. The goal of this coverage is to keep you in the same financial condition as before the loss. The coverage pays for temporary living expenses such as living facilities, meals, moving expenses and temporary rentals.

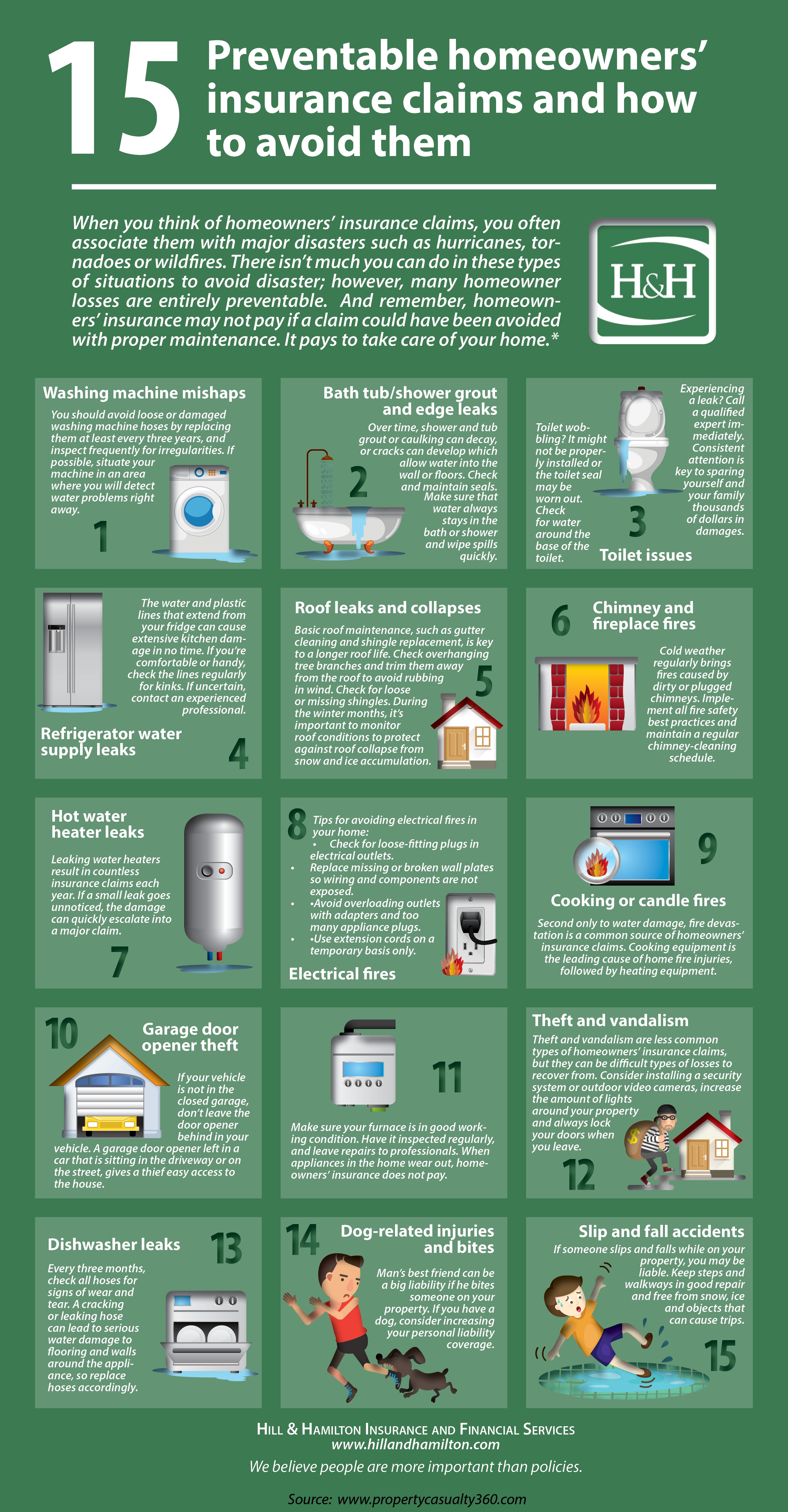

Curious about what you can do to prevent 15 common homeowners insurance claims?

Have questions about your home insurance coverage?

If you have questions, you’re concerned about your limit of coverage for additional living expenses, or just concerned about your level of protection in general, the licensed insurance advisors at CoverLink can help. It’s great to be an informed insurance consumer, but you shouldn’t be expected to be your own insurance agent…we’re here to help and make your life easier!