If you’re doing any online research for insurance, you’ve likely encountered more than a few discussions highlighting the problems associated with insurance.

I know it’s hard to imagine, but very few people will stand up and proclaim their undying adoration and love for insurance. The most common complaint is the cost.

But why is that?

Is there a reason so many consumers don’t see the value? Or perhaps, the question is whether there’s even value there to begin with?

We’re going to explore the answers to those questions, as well as several others that we encounter on a daily basis.

1. Insurance is too expensive, especially for a product that I can’t touch

True, insurance is often referred to a promise rather than a tangible product.

But too expensive is completely relative.

Sure, if you pay your insurance for 20 years and never have the slightest need to use it, you might argue it’s expensive.

On the other hand, the driver that caused a 4-person accident sending a family to the hospital with rather serious injuries, ultimately resulting in more than $892,000 in medical bills, lost wages and replacing the car, certainly wouldn’t argue that his insurance was ‘too expensive.’

So the ultimate question you have to ask is what price do you put on security and stability?

The money you pay isn’t about getting something tangible in return. It’s about making sure your personal property is protected and your assets can’t be taken because of a lawsuit – legitimate or frivolous.

Those things – your house, cars, investments, wages – certainly are tangible. And if disaster strikes, your focus should be on reclaiming your sense of stability. The last thing you should worry about is money. It helps to look at the cost of insurance as an investment you hope you never have to see returns on, but you’ll be glad that pot of money is there if you ever need it.

For example, imagine your house catches on fire and you don’t have any homeowners insurance. The house is not a complete loss, but it’s severely damaged and is uninhabitable for at least three months. To repair all the damage it will cost you approximately $40,000. In addition, all of your kitchen appliances need replaced, and most of your furniture and clothes have significant smoke damage, which is going to cost an additional $20,000 to replace or restore.

But that’s not it – where are you and your family going to live while those repairs are being done to your home, and how much will that cost you? Now is when that insurance investment you chose not to purchase would be coming in handy. You hope that your home would never catch fire and much of your belongings would be destroyed, but life happens. Insurance provides the peace of mind in knowing you would be protected when a disaster does happen and all of those tangibles would be replaced.

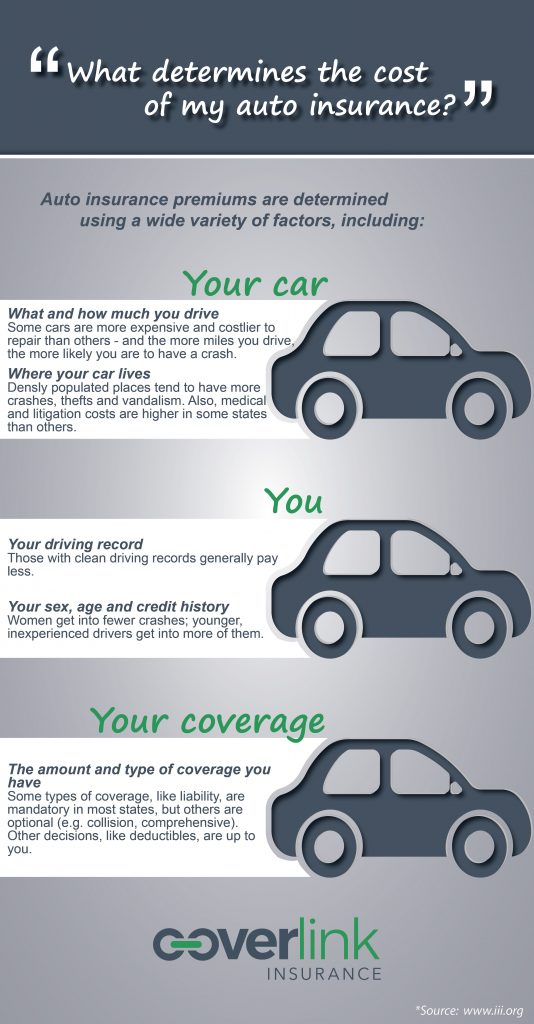

And insurance doesn’t have to be too costly, depending on what types of coverage you choose. The insurance policy is hugely customizable, so you can select as much, or as little, coverage to suit your needs and budget.

Yes, the insurance product is intangible, but remember that you’re actually getting protection for your tangible stuff (your assets, possessions, etc.). In other words, you’re paying for your security – by transferring your risks, such as loss of properties due to fire or theft, or loss of ability to work due to an accident, to the insurance company.

2. It’s confusing

It’s rare to find a person who has actually read their entire policy and all its endorsements. While everyone should read them, they’re not exactly what we’d call light bedtime reading.

Insurance policies are legal contracts, and it takes a special kind of person to actually enjoy reading and understanding those policies. Some people call us weird… some think we’re just nuts, but we actually enjoy reading and understanding insurance policies. Not because reading them is fun but because we love to be in a position to help consumers understand what they’re purchasing and what it will do for them.

So, what do you do?

Do you read your entire policy? Do you get your agent to explain it to you?

The fact is, insurance doesn’t have to be confusing if you spend your time finding and selecting the right advisor rather than trying to understand the intricacies of the insurance product.

An insurance advisor serves as your consultant and your advocate. With knowledge of the industry, various carriers, local knowledge and more, we can provide you with the peace of mind that you have the right coverage. And most importantly, you know that if something were to happen, help is simply a phone call away.

3. I’ve paid my premium for years, and then when I finally have a claim, it’s denied

This is the most common complaint we hear when consumers initially reach out to us and ask us to take over the servicing their insurance needs. They’re upset because the insurance they purchased didn’t do what they thought it should, and they’re looking for us to fix the problem going forward.

Yes, this type of situation can, and does, occur frequently. Most often what we find after doing a comprehensive review is that the right type of coverage was not in place.

Simply going online and purchasing insurance for the cheapest price doesn’t mean that you’re getting the right policy for your specific needs. Insurance is not a ‘one-size-fits-all’ product; if it’s not tailored to your specific needs, it might not do what you expect it to when you need it.

The options and decisions can be overwhelming and confusing. If you watch TV at all these days, you’ll see countless advertisements for quick, easy and cheap insurance. These advertisements promise significant savings on your insurance in exchange for just a few minutes of your time. But it’s important to question what you may be giving up in return for ‘quick, easy and cheap.’ And how comprehensive is your coverage if it’s put together in just a few minutes?

With all the factors included in your purchase, like price, coverage, exclusions, endorsements and more, it’s important to work with someone who is experienced and knowledgeable in the business.

Finding the right coverage for your needs often involves research, but you don’t need to conduct this research alone. Instead, you can opt to work with an independent insurance agent who will review many different insurance companies’ rates and coverage options to determine the best fit for you. An independent agent will ensure that you have the proper coverage in the event of a claim and will fight for you to make sure your claims are never denied. Take a look at some of the additional benefits of working with an Insurance Advisor versus trying to figure this out on your own.

4. I hate dealing with insurance

Hey, we get it… in an idealistic world, we’d all rather take the money we’re spending on insurance and go shopping on Amazon. However, when the fire, theft, car accident or lawsuit happens, everyone wants the protection and peace-of-mind that insurance provides.

Perhaps the solution to this complaint should be to approach the insurance buying process from a different perspective. Instead of trying to understand the product, compare the thousands of companies that could potentially provide the product you need, and then determining which combination of coverage, service and price best meets your needs, why not start by researching the Insurance Advisor you’d like to work with?

Look for someone that absolutely loves insurance and what it can do for clients when set up properly. We can’t promise that you’ll love insurance when you’re done, but at least you’ll know you have someone working and advocating on your behalf that does love insurance, and will do everything possible to make sure you have the protection you need.

The right Insurance Advisor will always have your best interest in mind, by asking the right questions, listening to your needs and helping you determine what type of coverage best suits those unique needs.

Conclusion

It’s no coincidence that we have legitimate solutions for the top 4 complaints when it comes to insurance. We understand your frustrations, and why it may seem confusing at times. We understand the value that protection and stability provides and we understand the intricacies of each individual policy.

That’s why we’re here.

We’ll work with you to get the right policy in place to protect you when a disaster occurs – a policy that reflects your unique needs. We’ll eliminate the confusion, and never lose sight of your budget. And finally, we’ll always be your advocate. From providing you the best possible price WITH the best possible protection to setting you up with a policy reflective of your specific needs or guiding you through a claim, we’ll always be there for you.