As a business owner in the home improvement industry, you make it possible for your customers to update and protect their homes; often their greatest and most valuable asset.

You provide products and furnishings that help home owners increase the value of their investment, and you offer safety devices like smoke alarms, carbon monoxide detectors, and high quality dead bolt locks.

Essentially, you’re helping your customers protect and grow one of their most valuable assets.

But have you ever stopped to consider whether you’re doing the same for your own business?

The fact is, there are so many risks you and your business face on a daily basis, and without proper consideration and planning, you could be risking everything you’ve worked so hard to achieve.

Unfortunately, you can’t predict everything that could adversely impact your business, and sometimes, bad things just happen.

However, one step you can take now is to protect your business from any fallout of these unforeseen events by putting the right insurance policies in place.

But buyer beware…

A one-size fits all insurance plan could end up costing thousands, or even millions of dollars, at a time when you need your insurance protection the most.

The fact is, many small business owners think all insurance is the same. They purchase an ‘off-the-shelf’ policy because it appears to have all the coverages they need, it’s cheap, and most of all, it’s easy.

But is your small business just like every other small business out there? Or even the same as every other home improvement store? Do you have unique services or products that you offer that set you apart? Do you offer benefits to your customers that many others don’t?

Unless your business is exactly the same as every other small business, you shouldn’t expect an insurance policy that’s exactly the same. You deserve a policy that’s as unique as you and your business… and quite frankly, you should accept nothing less.

That’s why it’s important to work with your independent Insurance Advisor who can help you determine your risks, what types of coverage will fit your specific business needs, and how to accomplish all of this within your budget.

What are your business risks?

Owning a home improvement store is not typically a high-risk business; however, there are some exposures that you should be aware of including:

- Identity theft and access to customer information

- Lawsuits

- Slips and falls

- Theft

- Vandalism

- Weather events (like snow, ice or hail)

- Equipment failure

And this list only scratches the surface… most home improvement stores face additional risks or threats to their business that need to be thoroughly considered and addressed before a loss ever occurs.

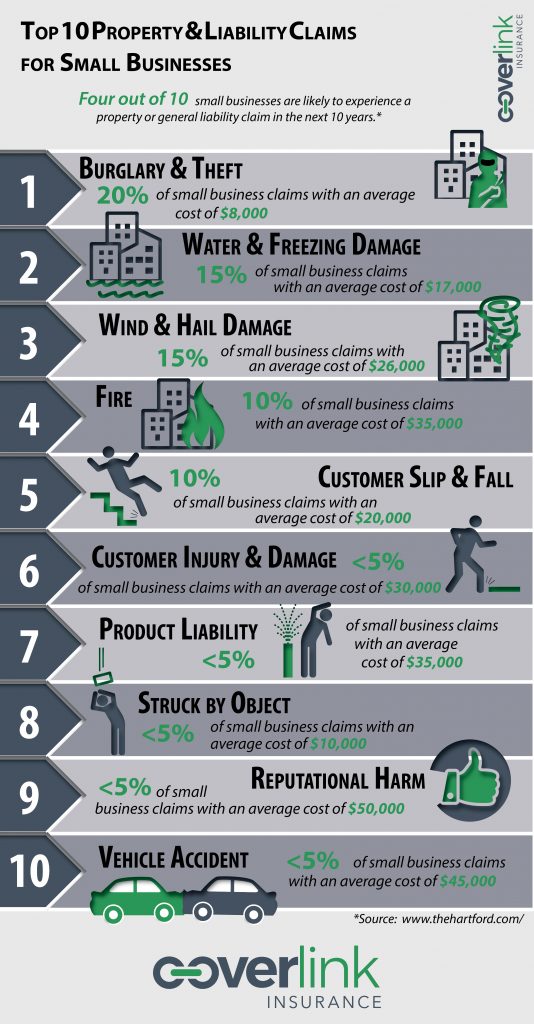

Curious about the top 10 property & liability claims impacting small businesses?

What types of insurance do you need?

Commercial Property Insurance

Weather is hugely unpredictable in Ohio; we’ve had our share of catastrophes from hail events to the aftermath of hurricanes that made their way through The Buckeye State leaving a path of wreckage.

When fire, theft, wind, hail, lightning or other disasters strike your business, you need to be prepared for what you can control (essentially, how can you respond to help mitigate further damage), and have a plan in place to recover financially from those risks that you can’t control.

A Commercial Property Insurance policy will cover the building you’re located in, as well as the contents of your building, including light fixtures, office equipment, furniture, computers and more.

For example, if the roof to your building collapses because of the massive buildup of snow and ice, the damage to your inventory could be devastating. Add to that the cost to repair your building, and you could easily be looking at damages significant enough to put you out of business.

But, with the right Commercial Property policy, you would have coverage for the damages to the building, as well as the replacement cost of the damaged contents.

Commercial General Liability Insurance

Every home improvement store in Ohio must have aCommercial General Liability (CGL) insurance policy. This coverage would protect you when lawsuits or financial losses occur.

A typical CGL policy provides coverage for claims of bodily injury or other physical injury, personal injury (libel or slander), advertising injury and property damage as a result of your products, premises or operations.

Imagine one of your customers is reaching for an item that’s on a shelf above her head. She underestimates the weight of the box, and it falls on her causing significant head and neck injuries. Regardless of whether she should have been attempting to lift the box on her own, would you know what to do if she needed to be taken by ambulance for treatment?

Or worse, if weeks later, lawsuit papers show up with your name on them?

With the right CGL policy, not only would the injuries and medical expenses be covered, but if that lawsuit does occur, you would have coverage for the legal costs incurred.

As a safeguard against liability, CGL enables you to continue your normal operations while dealing with real or fraudulent claims of negligence or wrongdoing. CGL policies also provide coverage for the cost to defend and settle claims.

Privacy Liability & Data Breach Insurance

This coverage, often referred to as Cyber Liability, has gone from a little known option in the insurance world to an absolute must-have given the number of data breaches, and the costs associated with even a small breach.

Consider the amount of personal information you collect, store and use in your business. This information could be in digital format, hard-copy, or both. For most home improvement stores, the greatest risk comes from the hundreds, if not thousands, of credit card transactions that occur each month.

Now imagine opening your doors to many of the most unscrupulous individuals for the next six months, and allowing them to access and use any information they want.

Sounds crazy, right?

But this is exactly what’s happening in our digital world. Breaches occur to the largest, and smallest businesses… no one is immune.

A data breach often goes unnoticed for months, and by the time it’s discovered, the personal information stolen has already been used to wreak havoc on the victim’s identity and finances.

It’s really not a question of whether your business will suffer a breach, only a matter of when. Without Privacy Liability & Data Breach Insurance, you’re on your own to navigate the increasing number of local, state and federal regulations you must comply with, in addition to the legal costs and damages you’ll suffer.

Additional insurance coverage options all home improvement stores should consider

Business Income Insurance (also known as Business Interruption Insurance) is an option that you may want to consider, as it’s designed to cover the loss of income you would suffer after a disaster.

Business income coverage protects against the loss of income a business suffers when a covered loss causes damage to the insured premises. The loss doesn’t have to cause the business to shutdown entirely. Even a covered loss that causes the business to slow down can be covered with business income coverage.

Remember that roof collapse claim that occurred, destroying all your inventory? If you had Business Income coverage, the sales slump you’re sure to experience while you’re rebuilding your inventory and restoring your building could be covered.

Equipment Breakdown Insurance would protect your business, and more specifically, the equipment that’s critical to operating your business on a daily basis.

The standard Commercial Property policy (discussed above) specifically excludes coverage to your equipment (HVAC, refrigeration, computer systems, etc.) for certain types of claims or losses that you could suffer.

These exclusions in the property policy create gaps in coverage for many businesses, and Equipment Breakdown coverage has been developed to fill these gaps for those businesses needing the coverage.

Conclusion

This is only the beginning to the insurance coverages that Ohio home improvement stores need to consider. However, if you have these policies in place, you can form a solid foundation of protection for your business.

Finding the best insurance policy for home improvement stores in Ohio, and figuring out the types of coverage needed to protect your business, can be confusing, time consuming and difficult.

However, the right insurance protection is still critical to the success of your business. Without it, you’re one claim away from being out of business.

And remember, not all policies are created equal.

You probably wouldn’t go to your eye doctor instead of your dentist if you were having a toothache, right? Just because they’re both doctors doesn’t mean they have the same skillset.

Just the same, you need an Insurance Advisor that understands your industry, your risks of loss, and how best to protect you and your business.

We can help.

We know the industry, we understand your needs, and we work with multiple insurance companies so we can deliver the insurance solution that’s perfect for your business, and your budget.

In addition, we can also provide you several services that will help position your business for the best insurance premiums offered by the nation’s strongest insurance carriers. Specifically, we can:

- Provide you with data security resources designed to help keep your data, and your network, safe

- Perform a data breach risk assessment of your business to help identify areas of weakness, and offer solutions to mitigate the exposures

- Offer safety manual material so you can mitigate your risks of a claim occurring, reduce the number of employees being injured on the job, and comply with OSHA requirements

- Review our 86-point ‘Property Inspection Checklist’ to help you prevent claims to your building that you’re capable of controlling

The bottom line is, when you have confidence in your business insurance, you have greater peace of mind knowing that you can keep working to generate revenue, even when disaster strikes.

To get started on your customized solution, contact one of our Licensed Advisors, or Request a Proposal and we’ll get to work right away.