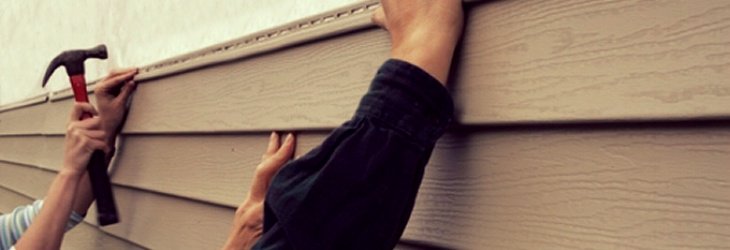

The installation of new siding on a home is an important job, and it can significantly increase its curb appeal.

Not to mention, when done right, it can improve the home’s insulation allowing homeowners to save on heating and cooling costs.

It should be no surprise that any good siding installation project starts with a solid product, and a great installation contractor. And if you’re in the siding installation business, then you know you have a responsibility to provide both.

Chances are, you’re running a retail or office space for your customers to select the products they want. Once product selection is complete and materials are delivered, you’re on your way to your customer’s location to begin installation.

These very basic business functions may be so routine to you that you don’t give them a second thought. But to a Licensed Insurance Advisor, there are numerous risks that need to be addressed here.

Like any other business, siding installers need a variety of insurance coverages to ensure their operation is protected. Additionally, rules and coverages can vary from state to state, so understanding Ohio Siding Installation Insurance is essential.

Commercial General Liability Insurance

If you’re a siding contractor then a Commercial General Liability (CGL) insurance policy is a must, as it would protect when lawsuits or financial losses occur.

A typical CGL policy provides coverage for claims of bodily injury or other physical injury, personal injury (libel or slander), advertising injury and property damage as a result of your products, premises or operations.

For example, you complete a siding project for one of your clients and months later you receive a call from them saying the siding wasn’t installed properly. They’re claiming that when it rains, water is making its way into their house damaging carpet, drywall and other household items. Without a CGL policy, your siding installation business would be paying for the damages out of pocket.

As a safeguard against liability, CGL enables you to continue your normal operations while dealing with real or fraudulent claims of negligence or wrongdoing. CGL policies also provide coverage for the cost to defend and settle claims.

Commercial Auto Insurance

Commercial Auto Insurance is another important policy that all Ohio siding installation businesses must consider because you’re relying on vehicles to get you from one client to another. Doesn’t matter if you have one truck, or a fleet of 100, you still need Commercial Auto Insurance.

The trucks or trailers that you’re using to haul your equipment and siding should be insured. A Commercial Auto Policy can be used to insure vehicles for:

- Liability – this would protect the business owner in the event of an at-fault accident where the owner, or any employees, caused injuries to others while driving a company vehicle

- Physical damage to the vehicles owned by the business if they’re involved in an accident, stolen or vandalized

- Or both Liability and Physical Damage

For example, one of your employees could be hauling a trailer full of siding for a new home build and they’re involved in a severe collision with another driver.

Your employee is at fault, there is extensive damage to both vehicles, and there will be medical expenses for both drivers.

Your Commercial Auto policy could cover the property damage, the medical expenses and any potential legal costs involved.

Contractor’s Equipment Insurance

Siding contractors usually have a fair amount of tools and products to be installed. These items could be found at your business, in one of your vehicles or on the job. Because these items move around, the best way to insure them is with an Inland Marine Insurance policy (also known as a contractor’s equipment policy or floater).

For example, you left all of your tools, equipment and siding at your customer’s site overnight. When you returned in the morning, all of your tools and siding had been stolen. An inland marine policy would cover the costs even though it didn’t occur on your business premises.

If you relied on your Property Insurance policy to cover these items, you could be very disappointed to learn that you have no coverage because the theft didn’t occur at your business premises.

Conclusion

Finding the best insurance policy for Siding Installation Contractors in Ohio, and figuring out the types of coverage needed to protect your business, can be confusing, time consuming and difficult.

However, the right insurance protection is still critical to the success of your business. Without it, you’re one claim away from being out of business.

And remember, not all policies are created equal.

You probably wouldn’t go to your eye doctor instead of your dentist if you were having a toothache, right? Just because they’re both doctors doesn’t mean they have the same skillset.

Just the same, you need an Insurance Advisor that understands your industry, your risks of loss, and how best to protect you and your business.

We can help.

We know the industry, we understand your needs, and we work with multiple insurance companies so we can deliver the insurance solution that’s perfect for your business, and your budget.

When you have confidence in your business insurance, you have greater peace of mind knowing that you can keep working to generate revenue, even when disaster strikes.

To get started on your customized solution, contact one of our Licensed Advisors, or Request a Proposal and we’ll get to work right away.