Artificial Intelligence (AI) technology, which has surged in popularity in recent years, encompasses machines and devices that can simulate human intelligence processes. Applications of AI systems are widespread, but some of the most common include computer vision solutions (e.g., drones), natural language processing systems (e.g., chatbots), and predictive and prescriptive analytics engines (e.g., mobile applications). According to the International Data Corporation, the market for AI technology and other cognitive solutions is projected to exceed $60 billion by 2025, up from $1 billion in 2015. In light of this growth, it’s imperative to understand the benefits and ramifications of such technology.

AI systems can potentially improve loss control measures and claims management practices for several lines of coverage.

For example, this technology can be utilized as a valuable safety tool to help mitigate workers’ compensation exposures and associated losses by way of providing prompt diagnoses when employees get injured on the job, generating customized treatment plans to improve recovery outcomes, selecting ideal health care providers, detecting injury patterns and anomalies, determining fundamental causes of workplace incidents and suggesting methods to prevent future losses, and reducing overall claim complexity. In addition, AI tools can help companies boost operational efficiencies through automated workflows, promote greater decision-making capabilities with predictive insights and conduct more effective due diligence processes in the boardroom. This technology could, in turn, reduce companies’ corporate exposures and related liability concerns. Further, carriers across coverage segments can leverage this technology to detect insurance fraud, assess policyholders’ unique risks and provide 24/7 assistance throughout claims processes.

Nonetheless, AI systems also carry risks for the insurance space. In particular, since this technology still relies on human algorithms, any inaccuracies or mistakes made during the initial input process could perpetuate company wide biases and produce serious errors amid corporate decisions, exposing businesses to various lawsuits and related claims.

Geopolitical Upheaval

This past year saw the continuation of severe geopolitical upheaval and international disruptions, particularly those relating to the ongoing Russia and Ukraine conflict, shifting trade dynamics between China and the United States, rising tensions amid the Israel-Hamas war and growing nation-state cyberthreats. These global events have had far-reaching impacts, prompting new tariffs, export restrictions, economic sanctions and coverage exclusions. Further, such events have exacerbated existing technological challenges, inventory backlogs, material shortages and supply chain issues. According to a recent survey conducted by Oxford Economics, more than one-third (36%) of businesses currently view geopolitical tensions as one of the top risks facing the global economy. As these events continue, companies should prepare for potential disruptions by closely monitoring evolving global trade policies and considering domestic production solutions (e.g., switching from an international vendor or raw material to a U.S. alternative) to ensure business continuity.

One of the most significant concerns associated with geopolitical upheaval is the extent to which losses stemming from international disruptions are covered by commercial insurance policies, especially as it pertains to instances of war; for example, war exclusions are common for both commercial property and cyber coverage. Regarding cyberwarfare, research from technology company Microsoft found that nation-state cyberattacks targeting critical infrastructure have jumped by 20% since 2021. Yet, securing adequate coverage for related damages has proven challenging due to war exclusions. Although these exclusions are fact-specific and often vary between policies and carriers, they generally state that damages from “hostile or warlike actions” by a nation-state or its agents won’t receive coverage. Such exclusions were created to help protect carriers against potentially systemic losses that may arise amid attacks by governments, their militaries or associated groups.

2024 Market Outlook Forecast Trends

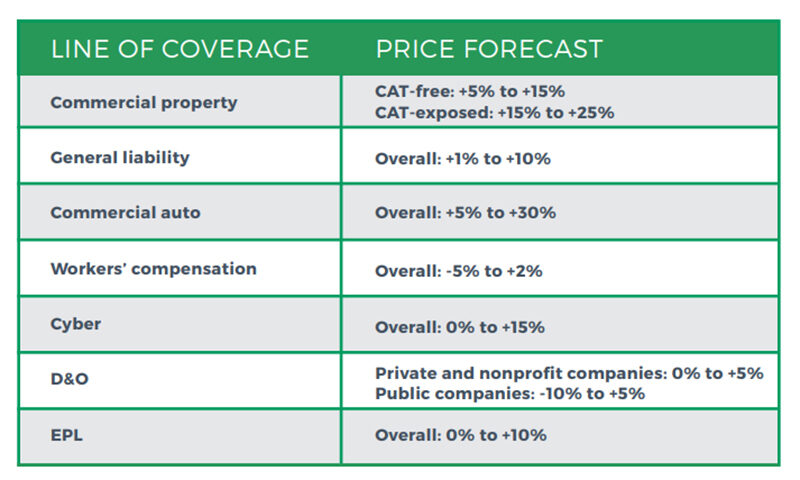

Price forecasts are based on industry reports and Zywave surveys for individual lines of insurance. Forecasts are subject to change and are not a guarantee of premium rates. Insurance premiums are determined by a multitude of factors and differ between businesses. These forecasts should be viewed as general information, not insurance or legal advice.

Any market swing is beyond your control; with expertise and knowledge from your insurance advisor, you can manage the impact to your business. Contact one of our trusted advisors today if you’d like help or guidance navigating the rapidly changing insurance market.