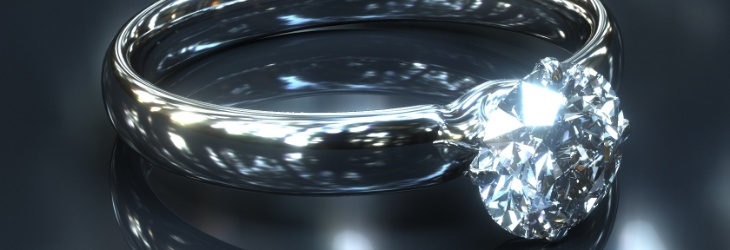

Too often, people are surprised to learn their jewelry, especially their expensive jewelry, is not properly insured.

Many homeowners assume that their jewelry is adequately covered under their homeowner’s insurance but you may be surprised to learn the facts…

While homeowner’s policies do cover jewelry, this insurance is usually subject to a much lower limit than the overall contents coverage. This reduced limit is called a “sublimit”. A typical sublimit is $1,500 for loss by theft of jewelry, watches and precious and semiprecious stones.

If your jewelry is worth more than the sublimit in your homeowner’s policy, you should consider purchasing specific insurance to cover it.

The following is a good process to follow:

- Schedule an appointment with your agent to review your jewelry coverage. Bring as much information about your jewelry portfolio as possible, including any appraisals.

- If your high-valued jewelry has not been appraised within the last 3 years, consider obtaining an appraisal from a reputable jeweler. Insurance companies often require more expensive jewelry to be appraised by a graduate of the Gemological Institute of America (GIA). The Institute’s G.G., G.J. or A.J.P. designations at the end of an individual’s name indicate that the jeweler has achieved a high level of professionalism with an education backed by a respected nonprofit organization.

- Make sure the appraisal has a description of the diamond’s four C’s:

1. Carat – The “carat” refers to the weight of the diamond.

2. Cut – The quality of the “cut” of the diamond results from the way light enters the stone and is reflected back. “Cut” is also used to refer to the diamond’s shape, such as round or pear-shaped.

3. Clarity – The “clarity” refers to the prevalence of minor spots, lines, bubbles, or other natural imperfections within the diamond.

4. Color – The “color” denotes the tint a diamond may possess.

- Remember that the better the appraisal, the fewer problems you will encounter with the insurer if you ever have to make a claim.

- Purchase jewelry insurance (insurance lingo calls this inland marine coverage) that can be added via an endorsement onto your homeowner’s policy. This endorsement (also available as a separate policy) provides much broader coverage than the limited protection found on the un-endorsed homeowners’ policy.

- Consider keeping any valuable jewelry you rarely wear in a safety deposit box at your bank.

- Review your jewelry protection with your independent insurance agent at least every 2 years or whenever you sell or purchase high-value jewelry.

So, if you received jewelry this Christmas and want to protect it from theft and damage, let us know. And, if you just realized the coverage in your homeowners policy is not enough to cover your jewelry, give us a call and we can help you make sure you get the coverage you want.