Auto insurance is meant to protect you by covering your bills after a car accident. However, the amount of compensation can vary greatly depending on the type of claim that’s made by insurance carriers and the value of your vehicle. The decision to have your vehicle repaired or declared a total loss directly impacts how much you receive.

Determining a Claim After a Car Accident

If you’re in an accident, the at-fault driver’s insurance carrier will analyze the approximate value of your vehicle before the accident as well as the cost to repair it afterward. Typically, the pre-accident value of your vehicle is determined by finding its actual cash value. This value is found by taking the price of a similar replacement vehicle in your area and then subtracting any pre-accident depreciation, such as your vehicle’s mileage and history.

If the cost to repair your vehicle is less than its actual cash value, insurers will usually opt to compensate you for the repairs. However, if the cost is too high or if the vehicle can’t be restored to a safe condition, insurers may declare it a total loss.

Total Loss Claims

If your vehicle is declared a total loss, you’ll be compensated with the full actual cash value of your vehicle, minus any applicable policy deductible. However, if a financed or loaned vehicle is declared a total loss, the insurer will pay the remaining balance to the finance company first. Here’s a breakdown of the two most common scenarios that occur when a financed vehicle is declared a total loss:

- The actual cash value of the vehicle is greater than the remaining balance of the loan. In this scenario, the insurer pays off the loan and then gives you the amount by which the actual cash value exceeds the loan balance.

- The actual cash value of the vehicle is less than the remaining balance on the loan. In this scenario, you are responsible for the difference between the actual cash value and the remaining loan balance.

Repairs and Diminished Value Claims

Getting a check for the full cost of your vehicle’s repairs may seem like a best-case scenario. However, repairs can substantially reduce your vehicle’s value. Even if it drives better than ever after being repaired, the fact that it was in an accident will taint its history and lead to a lower price if you ever choose to sell it. However, you can file a diminished value claim against an insurance carrier to try to recover any value that’s lost as a result of repairs.

Most states and insurance contracts prevent policyholders from bringing diminished value claims against their own insurers. However, if another driver is at fault for an accident and his or her insurance pays for your repairs, you may be able to use a diminished value claim to recover any lost value.

Because few vehicles are appraised immediately before they’re involved in an accident, it can be hard to prove that value has been lost after they’re repaired. Here are some tips you can use before and after an accident to prepare yourself for a successful diminished value claim:

- Check third-party websites to get an approximate value for your vehicle’s make and model.

- Take your vehicle to a pre-owned dealership after an accident for an appraisal. You can then ask for a letter that shows that your vehicle’s lower-than-average value is due to its repairs or accident history.

- Keep documentation about any repairs or enhancements to your vehicle. These documents can help show a more detailed history of your vehicle when determining its value.

- Contact us for more information about diminished value claims and to discuss the specifics of your situation.

Be Prepared

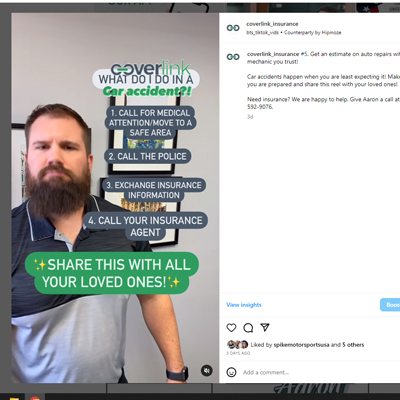

There are few things more dangerous and stressful than getting into an accident. Contact CoverLink Insurance today, we can provide you with a variety of auto resources and make sure you have the right types of coverage.