A new flood modeling tool that was released on Monday, June 29, 2020, suggests that Columbus, Ohio has nearly triple the number of properties at risk of flooding than are currently reflected on federal flood-plain maps. Further, the tool reflects the U.S. as a country that is severely under-prepared for damaging floods, both now and in the future.

According to the Columbus Dispatch, “the federal government’s best efforts to predict where flooding will strike have underestimated the risk to nearly 6 million homes and commercial properties primarily located in the nation’s interior, leaving them unprepared for potential devastation.”

In Columbus, alone, the new models suggests there are 10,053 homes and other structures that fall into the substantial risk category, meaning they face a 1% annual risk of flooding. However, the current Federal Emergency Management Agency (FEMA) model only places 3,789 properties in the city at risk level.

For the entire state of Ohio, the new model suggests that there are more than double the number of properties at risk than what has been recorded by FEMA.

This new analysis that was conducted by the First Street Foundation also suggests that conditions are getting worse with an increase of 1.6 million properties at a 1% annual risk of flooding by 2050. Franklin County is predicted to have an additional 2,000 properties in the high-risk category and 26,671 across the State of Ohio by 2050.

Why Does This Discrepancy Matter?

It’s important that the FEMA map accurately reflects the risk of flooding, as it’s used for a variety of reasons. The federal government uses the FEMA map to determine whether homeowners are required to purchase flood insurance, local and county planners use it to determine which areas are safe to develop and it’s used to determine plans for long-term development – like roads.

Why This Discrepancy Is Not Surprising

Many flood experts say the discrepancy between the two models isn’t surprising, given the limitations in FEMA’s calculations. FEMA is stretched thin, struggling to keep its flood maps up-to-date, particularly for inland areas that are perceived to be less vulnerable than the coasts.

In addition, FEMA also looks back at historical data to assess where flooding could strike next; leaving out current and future models that assess where risk might exist or be growing. With emerging weather patterns, historical weather data is becoming less reliable.

However, both models can be used, as FEMA’s maps and First Street’s model depict different kinds of risk and serve different purposes, said FEMA press secretary Lizzie Litzow. FEMA’s maps remain the backbone of effective flood plain management, as these maps have helped avoid over $100 billion in losses over the last 40 years. However, First Street’s Flood Factor Tool can be used to help inform a property owner of flood risks, and can aid in the decision of whether to buy flood insurance.

What Does This Mean for You?

Federal law mandates that all federal or federally related financial assistance for buying or constructing a building in high-risk flood areas be covered by flood insurance. That means any federally-insured bank or lender will require you to purchase flood insurance if you’re in an area more likely to be flooded.

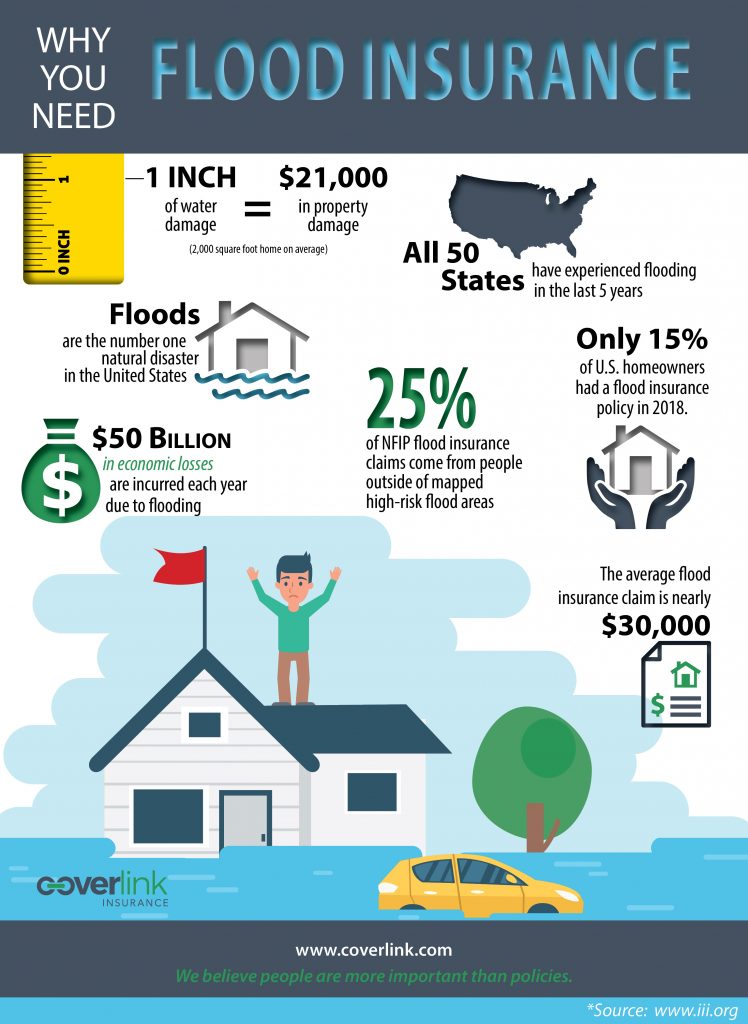

Property owners in low-to-moderate risk areas aren’t completely off the hook, though. Federal law may not require flood insurance, but lenders may make that call on their own because floods can happen anywhere that has rain and about a quarter of all flood claims come from outside of high-risk areas. Your home is collateral for your mortgage, so if it’s damaged or destroyed in a flood, the lender can take a big financial hit. They typically don’t like to take that risk, so they’ll often require you to purchase flood insurance to get a home loan.

Things can always change, too. If during the life of a mortgage a flood plain map is revised, which may be the case with First Street’s new tool, your lender may call you up and say you now are in a high-risk area and must purchase flood insurance.

Property owners who live in a Special Flood Hazard Area (SFHA), or high-risk area, that have received federal disaster assistance in the form of a federal grant or loan in the past for flood damage are required to have flood insurance for as long as they own the building. If they sell it, they have to tell the buyer about the need to purchase and maintain flood insurance. Not having the required coverage could mean no federal disaster assistance in the event of future damage.

But not all sellers need to disclose flood risks or past flood damage — only those who have received federal disaster assistance in a high-risk area. So if you’re buying a house, don’t automatically assume the seller or agent will tell you about past flood damage or flood zone designation.

Do I Need to Purchase Flood Insurance?

Many Ohioans believe coverage for losses caused by flood are covered under their homeowners, renters, or condo insurance policy… unfortunately, they’re not. Losses caused by a flood are customarily excluded on these policies.

You may be required to have separate Flood Insurance above the water damage coverage in your homeowners or renters policy.

For most people, this is not a major concern. How likely is Ohio to have a flood, right? But who expects to have a loss of any type? Most people don’t plan on having a loss and filing a claim under their insurance policy. However, when a loss does occur, even a flood loss, you don’t want to be on the hook for the entire loss amount.

Luckily, flood insurance is available in the State of Ohio. The state is divided into floodplains (essentially, how likely a certain area is to flood), and those areas more prone to flood are likely to purchase flood insurance. However, the Ohio Insurance Institute estimates that only 10% of the structures in Ohio’s floodplains are protected by flood insurance.

Tip. Find out what floodplain you’re in. Many people don’t realize how susceptible their property is to flood, and remember, we’re all in a flood zone.

If you determine you need flood insurance, there are several options available to you:

- Coverage for homeowners to protect their house and their personal property.

- Coverage for renters so they can protect their personal property.

- Condominium unit owners can purchase coverage to protect their condo and their contents (but check your condo contract, your association might already have purchased flood coverage)

Flood insurance is provided by the National Flood Insurance Program so there are standard restrictions and guidelines when it comes to purchasing a policy. Make sure you talk to an experienced insurance agent that can help you purchase the policy that’s best for you.

Note. Flood insurance is not cheap. The ultimate cost will depend on the amount of coverage you need, but keep in mind, flood losses tend to be fairly large. According to the National Flood Insurance Program, the average claim amount is $29,011.

It’s worth noting, the National Flood Insurance Program estimates that 90% of all natural disasters involve flooding so it’s certainly a coverage to consider when reviewing your overall protection.

If you would like to speak with one of our licensed advisors about possibly adding a flood policy to your insurance program, we’re here to help!

To learn more about your insurance protection, visit our Resource Center.