Let’s face it, most of us are putting in long hours today, saving for our retirement, in hopes that our nest egg will be sufficient some day for us to enjoy our golden years.

And there’s no shortage of investment advice out there…

Max out your 401(k), make sure your portfolio is diversified, contribute to a Roth IRA if you’re eligible, pay off debt, etc. ad nauseam.

Don’t get me wrong, all this advice is important to building and maintaining a nest egg worthy of your desired lifestyle in retirement.

But my biggest concern is this: what are investors doing to protect that nest egg they’ve worked so hard to build?

And I’m not talking about protection from swings in the market… I’m talking about the type of protection from financial catastrophes that can wipe out your entire nest in a single day.

For example:

- You’re on your way home late one evening after a long day at the office, you’re tired, you close your eyes for a split second… next thing you know, you’re at the hospital where you learn you crossed the median and hit a family of four head-on

- That loving 4-legged dog that’s normally great with little kids is having a bad day and snaps at the toddler trying to pet him, causing serious injuries that require stitches and will result in a scar on the child’s face

- The swimming pool you spend hours cleaning and maintaining has always been one of the reasons your friends love parties at your place… until one of your guests that’s had one too many ends up drowning

- Your teenage son just passed the test to get his license… he’s ecstatic; mom & dad are nervous, and for good reason. As he’s speeding through the neighborhood, he rolls the car taking out a fire hydrant which causes thousands of gallons of water to be released flooding multiple basements

It’s an unfortunate fact that accidents happen – and it’s not uncommon for jury awards and out-of-pocket court settlements to run into the millions.

While it’s difficult to pinpoint the monetary consequences of the risks you and your family take each day, the biggest mistake I see most consumers making is subscribing to the belief that they can only lose what they have.

They add up their net worth and assume that $100,000, or even $250,000 in insurance coverage is adequate to protect them in a catastrophic situation.

Unfortunately, that often ends up being a costly mistake… a massively costly mistake.

Why?

Jury awards rarely consider the assets of the at-fault party. Instead, they’re looking at the damages the at-fault party caused.

Damages such as:

- Medical bills

- Property that’s been damaged or destroyed

- Pain & suffering

- Lost income due to time away from work

- Attorney bills

- And once in awhile, the court likes to throw in punitive damages in cases of gross or severe negligence

And if the house, vehicles, savings accounts, investment properties, and retirement portfolios aren’t enough to satisfy the jury award, the next stop is wage garnishment.

Yes, the legal system allows your wages to be garnished until the judgment amount has been satisfied. And when this happens, typically there’s an interest rate attached to the garnishment since the assets available at the time of the judgment were not adequate.

This is precisely why Personal Umbrella Insurance is so important.

And it’s also why it’s critically important for consumers to understand this: when considering how much coverage you need, DO NOT base your decision on the amount of your assets or your net worth, you must consider the potential risks you and your family face on a daily basis that could cause substantial injury or damage to others.

For example:

- Do you have teenage drivers?

- Do you operate a business, whether from home or elsewhere?

- Does your profession make you an easy target for a large settlement?

- Do you have a pool, pond, trampoline or other attractive nuisance at your property (attractive nuisance is a hazardous object or condition on your property that’s likely to attract children)

- Do you own investment properties or rental dwellings?

- Are you inclined to participate in risky behavior such as pushing your $80,000 sports car to its limits?

These situations only begin to scratch the surface of the potential risks you and your family face. Ultimately, it comes down to this: you don’t have to have $1,000,000 to be sued for $1,000,000.

So why a Personal Umbrella Policy?

To begin, dollar for dollar, the Personal Umbrella Liability Policy is considered one of the best personal insurance buys.

Why?

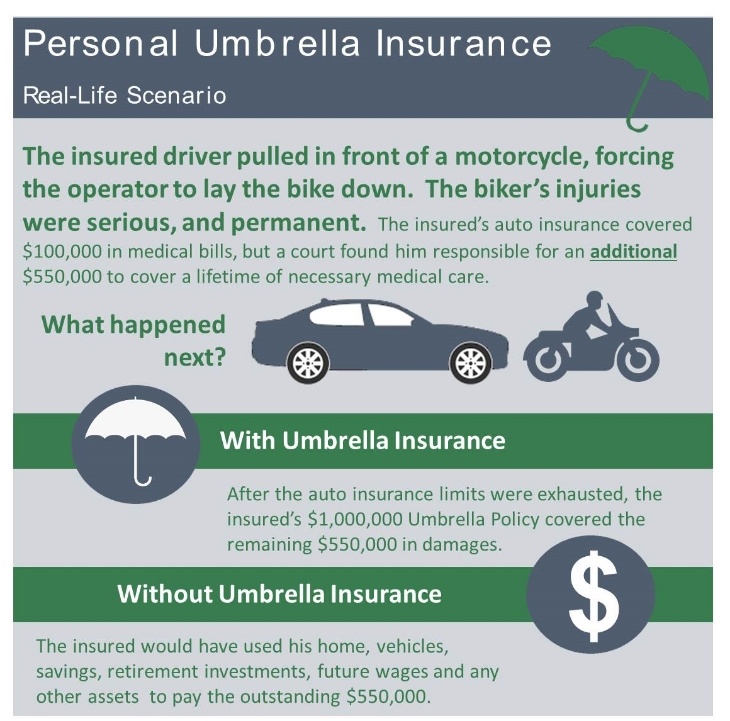

If you’re found to be legally liable for injuring someone (consider a serious accident like pulling in front of a motorcycle), without an umbrella policy, any damages beyond the limits of coverage provided by your standard liability policies will come out of your own pocket.

Like an umbrella that protects you from the rain, a personal umbrella liability policy provides an extra layer of insurance coverage over your standard liability policies. It protects your personal assets by kicking in when your standard liability coverage is exhausted.

Let’s take an example…

You have the standard auto liability insurance amount, which is $100,000 of coverage. You cause a serious accident and damages total $650,000. Without an umbrella policy, your insurance company writes a check to the injured party for $100,000 and walks away.

You’re left to settle the $550,000 balance.

With an umbrella policy, your insurance company could have paid the entire $650,000 in damages.

What coverage amounts are available?

Umbrella coverage starts at $1,000,000 and goes up to $10 million and higher. Again, you need to consider numerous factors when deciding how much coverage you need.

The old ‘rule of thumb’ was to determine your net worth and then make sure your Umbrella Policy was enough to cover that amount.

With the rise of litigation, medical costs and the general lawsuit-happy nature of many individuals looking for a huge payout, you need to be much more diligent when deciding how much protection you need.

So what’s the cost?

A typical $1 million umbrella policy will run you about $200 per year… not too bad considering the massive amount of protection you’re getting for your nest egg, as well as your other assets.

And to ensure you’re getting the most favorable premium for the coverage you’re buying, it’s a good idea to package all your liability policies with the same insurance company that’s providing your Umbrella Policy.

For example, if possible, you should have the same insurance company for your:

- Auto Insurance

- Homeowners Insurance (including Renters or Condo Owners)

- Motorcycle Insurance

- Boat Insurance

- Rental Dwelling Insurance (sometimes referred to as ‘investment properties’)

When structured this way, it’s possible for you to include an Umbrella Policy which will extend your liability coverage over all of the policies listed above.

If you’re unsure where to begin, give us a call… we’re here to help.

Or, if you want to find out just how affordable an Umbrella Policy can be in your situation, Request a Proposal and we’ll get to work right away on some options for you to consider.